Budget management is not an issue anymore! Become a pro in managing budget with our guide on the best online courses for Planning & Budgeting.

Are you struggling to manage your finances, stick to a budget, and achieve your financial goals? It’s time to take control and create a solid plan for success.

Imagine the peace of mind that comes with having a well-structured financial plan and budget in place. You could confidently work towards your goals, eliminate unnecessary stress, and enjoy a more secure future.

Discover the best online courses for planning and budgeting in our comprehensive review. We’ll guide you through top-rated programs, designed by financial experts and tailored to fit your unique needs. Learn to create effective plans, master budgeting techniques, and unlock the path to financial success.

Discover the best online courses that equip you with essential skills in planning and budgeting, enabling you to make informed financial decisions and achieve your financial goals effectively.

These are the top 10 courses that stand out. Each course is led by a renowned expert in their field. The courses are:

- “Personal & Family Financial Planning by Coursera”: Learn practical strategies and techniques to effectively manage personal and family finances, including budgeting, investments, and long-term financial planning, through this comprehensive course.

- “Budgeting and Scheduling Projects by Coursera”: Master the skills of budgeting and scheduling in project management, ensuring efficient allocation of resources, timely delivery, and successful project completion with this practical course.

- “Financial Analysis: Making Business Projections by LinkedIn Learning”: Enhance your financial analysis skills and learn how to make accurate business projections, including forecasting revenue, expenses, and profitability, through this comprehensive course by LinkedIn Learning.

- “Personal Finance Masterclass – Easy Guide to Better Finances by Udemy”: Gain mastery over personal finance management with this comprehensive masterclass that provides an easy-to-follow guide for improving your financial well-being and making informed financial decisions.

- “Financial Planning & Analysis: Building a Company’s Budget by Udemy”: Acquire the skills to develop and manage budgets for businesses by learning financial planning and analysis techniques in this comprehensive course offered by Udemy.

- “Budgeting in Real Life by LinkedIn Learning”: Learn practical budgeting strategies and techniques to effectively manage your personal and professional finances in real-life scenarios with this hands-on course by LinkedIn Learning.

- “Financial Freedom: A Beginner’s Guide by Alison”: Begin your journey towards financial freedom with this beginner’s guide by Alison, covering the essentials of personal finance, budgeting, savings, investments, and debt management.

- “Learn How to Budget! Personal Budgeting Made Easy in 16 minutes! by Skillshare”: Discover the art of personal budgeting and gain essential skills to manage your finances effectively in just 16 minutes with this concise and practical course offered by Skillshare.

- “Budgeting: How to Prepare a Cash and Functional Budget by Future Learn”: Develop the skills to prepare both cash and functional budgets, enabling effective financial planning and resource allocation, in this comprehensive course offered by Future Learn.

- “Fundamentals of Budgeting and Variance Analysis by Alison”: Master the fundamentals of budgeting and learn how to analyze variances between budgeted and actual financial results with this comprehensive course by Alison, enhancing your financial decision-making skills.

Our selection is based on a combination of factors, but we have sorted the courses by enrollment numbers to make the list more informative. The ranking number (#1 or #10) reflects only the number of enrollments among the best courses.

| Course | Instructor(s) | 💸Pricing | ❤️Enrollments | ⭐Rating | ⌛Duration |

|---|---|---|---|---|---|

| #1. Personal & Family Financial Planning by Coursera | Michael S. Gutter | $49 for a verified certificate | ❤️❤️❤️❤️❤️ 157,054 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (1,436 reviews as of Feb 2023) | ⌛⌛⌛ 15 hours |

| #2. Budgeting and Scheduling Projects by Coursera | Margaret Meloni | $39 for a verified certificate | ❤️❤️❤️❤️❤️ 154,782 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.7 (8,876 reviews as of Feb 2023) | ⌛⌛ 6 hours |

| #3. Financial Analysis: Making Business Projections by LinkedIn Learning | Rudolph Rosenberg | Subscription cost is $39.99 for a verified certificate | ❤️❤️❤️❤️❤️ 103,915 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.5 (536 reviews as of Feb 2023) | ⌛ 1h 17m |

| #4. Personal Finance Masterclass – Easy Guide to Better Finances by Udemy | Phil Ebiner +2 more instructors | $59.99 | ❤️❤️❤️38,979 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (2,723 reviews as of Feb 2023) | ⌛⌛ 7h 15m |

| #5. Financial Planning & Analysis: Building a Company’s Budget by Udemy | 365 Careers | $89.99 | ❤️❤️❤️35,699 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (7,666 reviews as of Feb 2023) | ⌛ 4h 31m |

| #6. Budgeting in Real Life by LinkedIn Learning | Natalie Taylor | Subscription cost is $39.99 for a verified certificate | ❤️❤️24,617 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.7 (297 reviews as of Feb 2023) | ⌛ 44m 30s |

| #7. Financial Freedom: A Beginner’s Guide by Alison | Christine Williams’ Alison Stats | Free ($10 for a verified certificate) | ❤️❤️22,888 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (717 reviews as of Feb 2023) | ⌛ 1.5-3 hours |

| #8. Learn How to Budget! Personal Budgeting Made Easy in 16 minutes! by Skillshare | BrainyMoney And Son Han | $14 for a verified certificate | ❤️❤️12,671 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (510 reviews as of Feb 2023) | ⌛ 20m |

| #9. Budgeting: How to Prepare a Cash and Functional Budget by Future Learn | Kaplan | $39 for a verified certificate | ❤️8,670 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.6 (117 reviews as of Feb 2023) | ⌛ 3 hours per week (3 weeks course) |

| #10. Fundamentals of Budgeting and Variance Analysis by Alison | NPTEL’s Alison Stats | Free ($10 for a verified certificate) | ❤️4,221 enrollments (as of Feb 2023) | ⭐⭐⭐⭐⭐4.7 (315 reviews as of Feb 2023) | ⌛ 3-4 hours |

Table of Contents

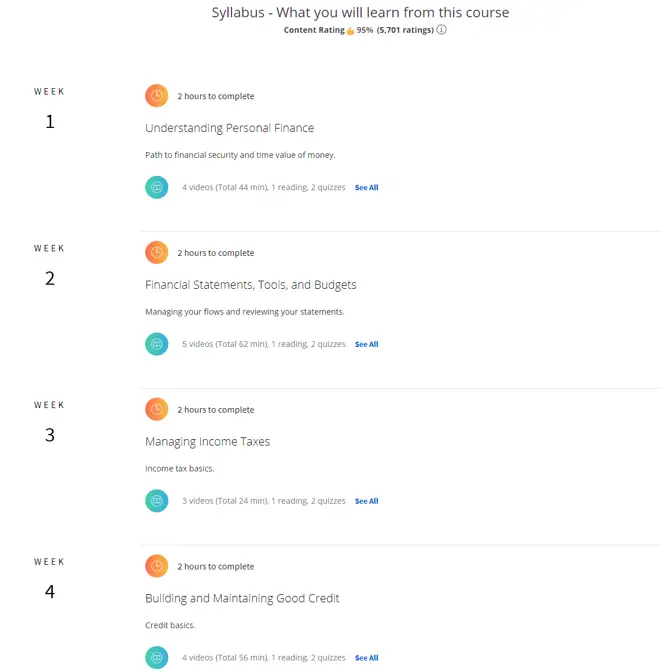

#1. Personal & Family Financial Planning by Coursera

- 🔗Course Link

- 💸Pricing: $49 for a verified certificate

- ❤️Popularity: 157,054 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (1,436 reviews as of Feb 2023)

- 📝Instructor(s): Michael S. Gutter, Ph.D. (Professor at University of Florida)

- ⌛Duration: 15 hours

The Personal & Family Financial Planning course on Coursera is designed to equip learners with the knowledge and skills needed to create a solid financial plan for themselves and their families.

Through interactive lessons, students will learn how to set financial goals, budget effectively, save for the future, invest wisely, and manage debt. The course also covers important topics such as insurance, taxes, and retirement planning.

With practical tips and real-life examples, this course offers a comprehensive guide to financial planning that can help students achieve long-term financial security for themselves and their loved ones.

Meet the instructor:

What you will learn:

#2. Budgeting and Scheduling Projects by Coursera

- 🔗Course Link

- 💸Pricing: $39 for a verified certificate

- ❤️Popularity: 154,782 enrollments (as of Feb 2023)

- ⭐Rating: 4.7 (8,876 reviews as of Feb 2023)

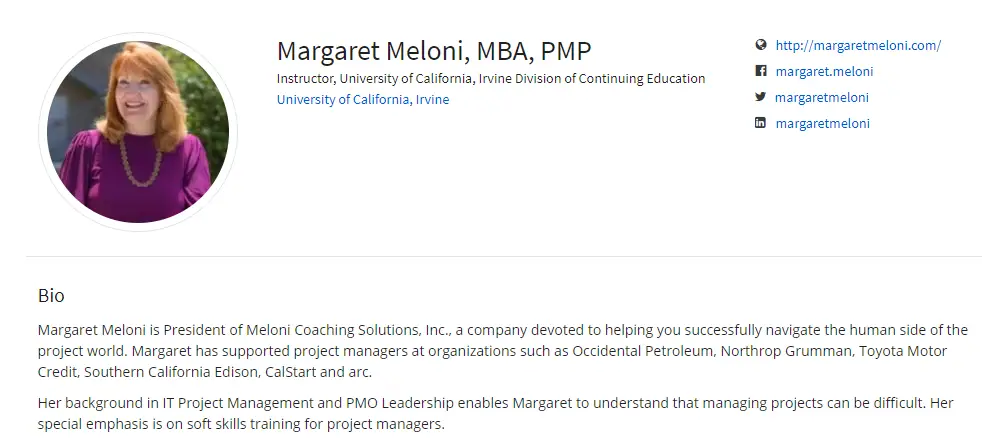

- 📝Instructor(s): Margaret Meloni, MBA, PMP (President of Meloni Coaching Solutions, Inc. Instructor at University of California.)

- ⌛Duration: 6 hours

The “Budgeting and Scheduling Projects” course by Coursera provides a comprehensive overview of project planning, budgeting, and scheduling. This course is designed for project managers, team leaders, and anyone involved in managing projects.

Through a series of interactive modules, participants will learn how to create realistic budgets, develop project schedules, and effectively manage project resources.

By the end of the course, participants will have the knowledge and tools to plan and execute successful projects while staying within budget and on schedule.

Meet the instructor:

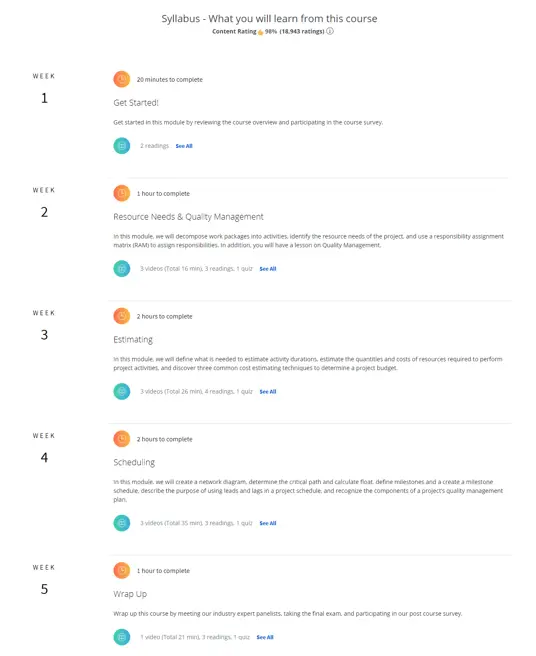

What you will learn:

#3. Financial Analysis: Making Business Projections by LinkedIn Learning

Key info

- 🔗Course Link

- 💸Pricing: Subscription cost is $39.99 for a verified certificate

- ❤️Popularity: 103,915 enrollments (as of Feb 2023)

- ⭐Rating: 4.5 (536 reviews as of Feb 2023)

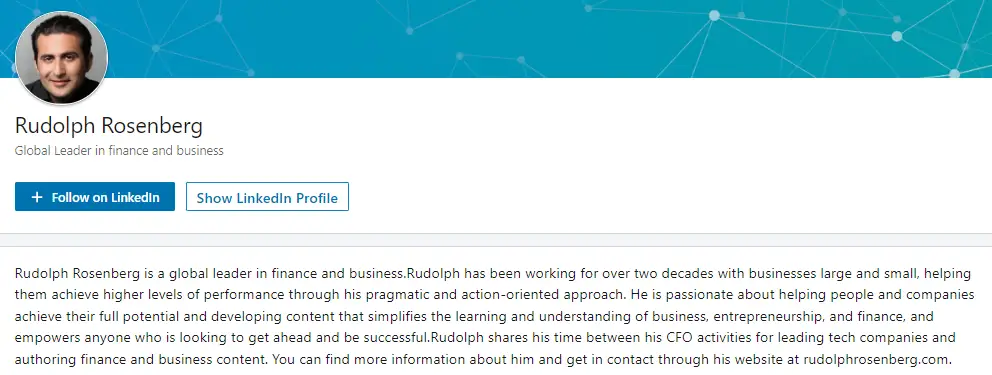

- 📝Instructor(s): Rudolph Rosenberg (Global Leader in finance and business)

- ⌛Duration: 1h 17m

“Financial Analysis: Making Business Projections” is a comprehensive online course offered by LinkedIn Learning that teaches learners how to use financial data to make informed projections and decisions for their business.

The course covers important financial statements, such as balance sheets and income statements, and teaches learners how to interpret and analyze them.

By the end of the course, learners will be able to create financial projections and prepare operational budgets that accurately reflect the financial health of their business, as well as make informed decisions based on financial data.

Meet the instructor:

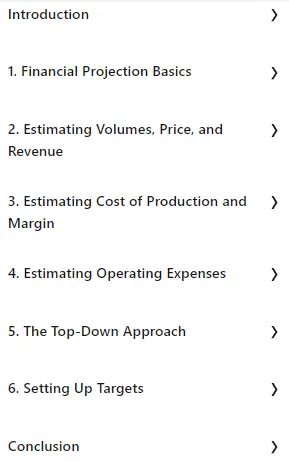

What you will learn:

#4. Personal Finance Masterclass – Easy Guide to Better Finances by Udemy

Key info

- 🔗Course Link

- 💸Pricing: $59.99

- ❤️Popularity: 38,979 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (2,723 reviews as of Feb 2023)

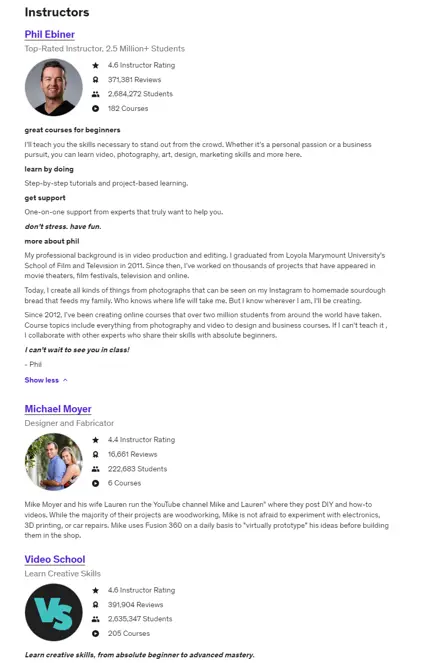

- 📝Instructor(s): Phil Ebiner (Top-Rated Instructor, 2.5 Million Students), Michael Moyer (Designer and Fabricator), and Video School (Online learning platform which offer creative skills)

- ⌛Duration: 7h 15m

The “Personal Finance Masterclass” is an essential course for anyone who wants to improve their financial well-being. Created by Udemy, this course provides a comprehensive yet easy-to-understand guide to better finances.

Whether you’re struggling to save money, manage debt, or invest wisely, this masterclass will give you the knowledge and tools you need to take control of your finances.

With practical tips, real-life examples, and interactive exercises, you’ll learn how to create a budget, build wealth, and achieve financial security for yourself and your family.

Meet the instructors:

What you will learn:

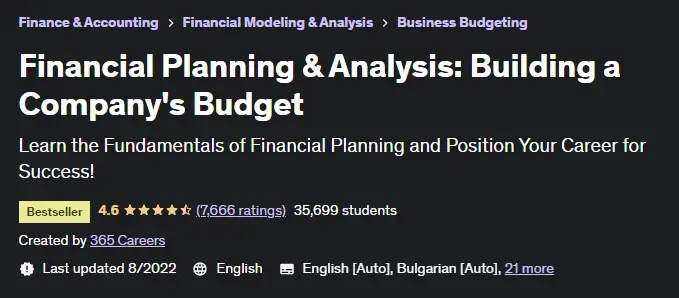

#5. Financial Planning & Analysis: Building a Company’s Budget by Udemy

Key info

- 🔗Course Link

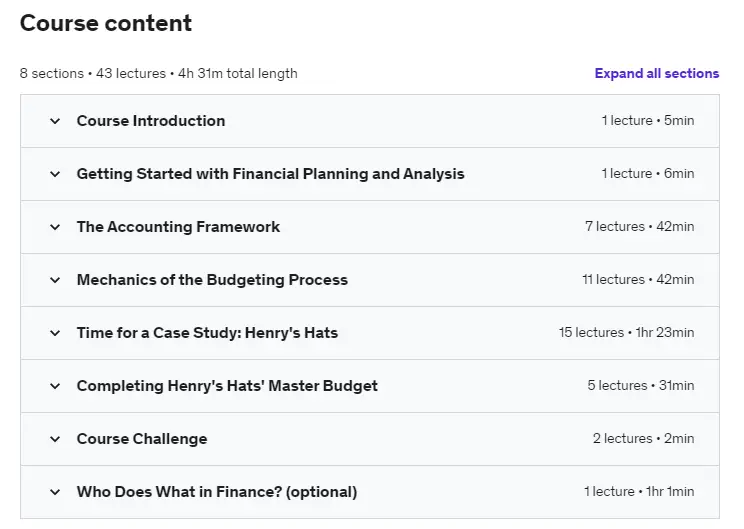

- 💸Pricing: $89.99

- ❤️Popularity: 35,699 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (7,666 reviews as of Feb 2023)

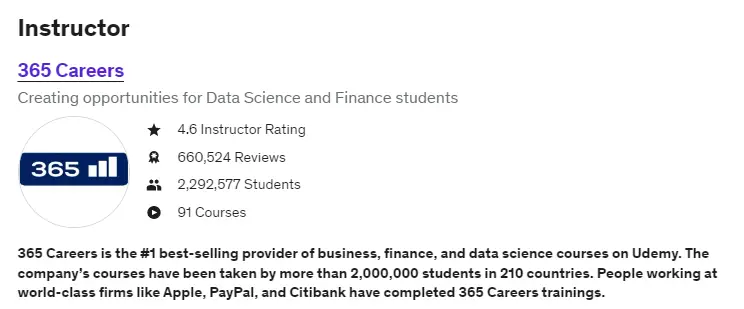

- 📝Instructor(s): 365 Careers (#1 best-selling provider of business, finance fundamentals, and data science courses on Udemy)

- ⌛Duration: 4h 31m

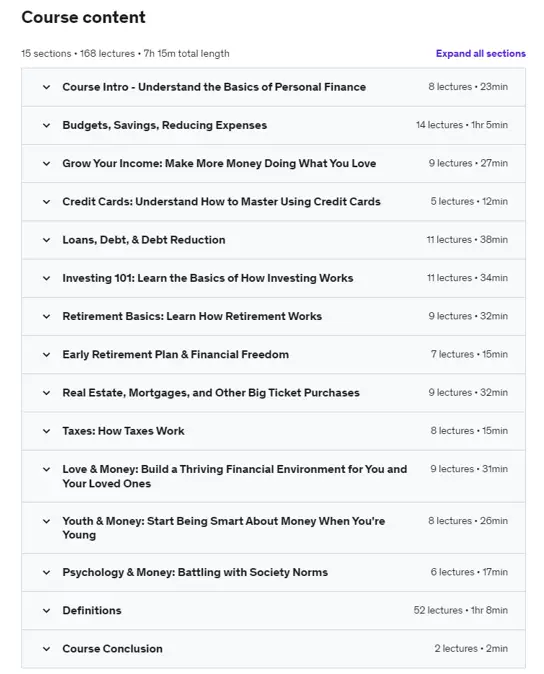

“Financial Planning & Analysis: Building a Company’s Budget” is an online course offered by Udemy that teaches the fundamentals of creating a company’s budget.

This course provides an in-depth understanding of financial planning and analysis, including revenue forecasting, expense management, and cash flow projections.

Participants will learn how to use financial modeling tools to create accurate and realistic budgets and gain the skills necessary to analyze financial data and make informed business decisions.

Whether you’re an entrepreneur or a financial professional, this course is essential for building a successful business.

Meet the instructor:

What you will learn:

#6. Budgeting in Real Life by LinkedIn Learning

Key info

- 🔗Course Link

- 💸Pricing: Subscription cost is $39.99 for a verified certificate

- ❤️Popularity: 24,617 enrollments (as of Feb 2023)

- ⭐Rating: 4.7 (297 reviews as of Feb 2023)

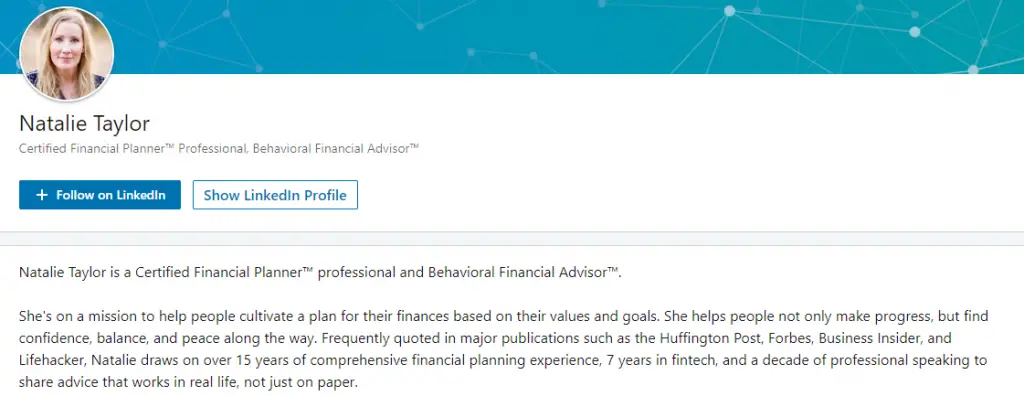

- 📝Instructor(s): Natalie Taylor (Certified Financial Planner™ Professional, Behavioral Financial Advisor™)

- ⌛Duration: 44m 30s

“Budgeting in Real Life” course by LinkedIn Learning equips learners with practical knowledge and skills to create and manage personal budgets effectively.

The course covers various topics, such as setting financial goals, tracking expenses, creating a budget plan, and adjusting the plan as needed.

Through real-life scenarios and examples, the course offers valuable insights into making informed financial decisions, reducing debt, and achieving financial stability.

Whether you’re new to budgeting or looking to refine your skills, this course provides a solid foundation for managing your finances.

Meet the instructor:

What you will learn:

#7. Financial Freedom: A Beginner’s Guide by Alison

Key info

- 🔗Course Link

- 💸Pricing: Free ($10 for a verified certificate)

- ❤️Popularity: 22,888 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (717 reviews as of Feb 2023)

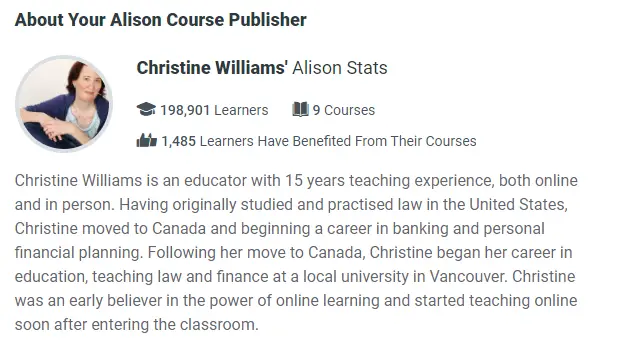

- 📝Instructor(s): Christine Williams’ Alison Stats (An educator with 15 years teaching experience, both online and in person.)

- ⌛Duration: 1.5-3 hours

Alison’s “Financial Freedom: A Beginner’s Guide” is an empowering course that equips students with the necessary skills to achieve financial freedom. Through practical exercises and expert advice, students will learn how to manage operational budget effectively, reduce debt, and save money.

The course also delves into investment strategies, retirement planning, and building wealth. By the end of the course, students will have the tools and knowledge needed to take control of their finances and build a secure financial future.

Meet the instructor:

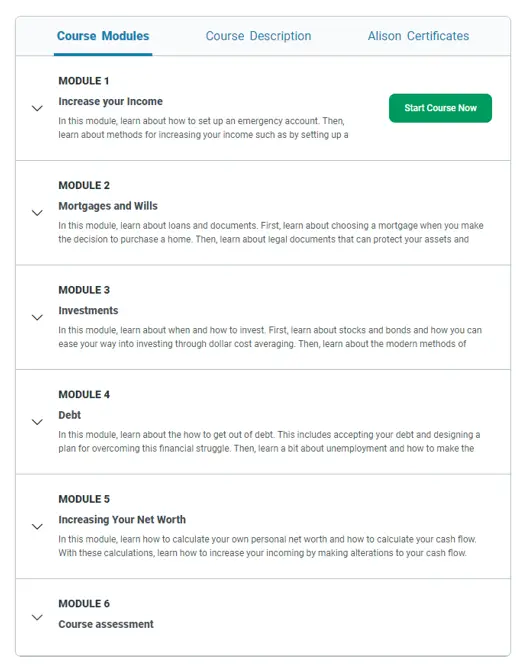

What you will learn:

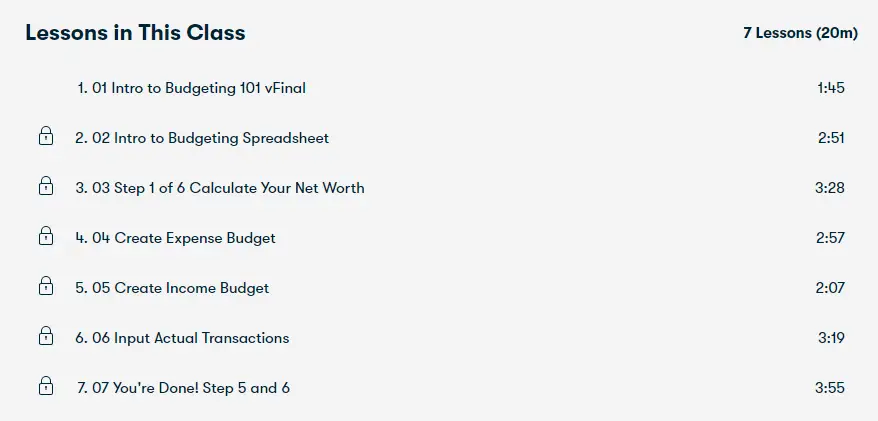

#8. Learn How to Budget! Personal Budgeting Made Easy in 16 minutes! by Skillshare

- 🔗Course Link

- 💸Pricing: $14 for a verified certificate

- ❤️Popularity: 12,671 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (510 reviews as of Feb 2023)

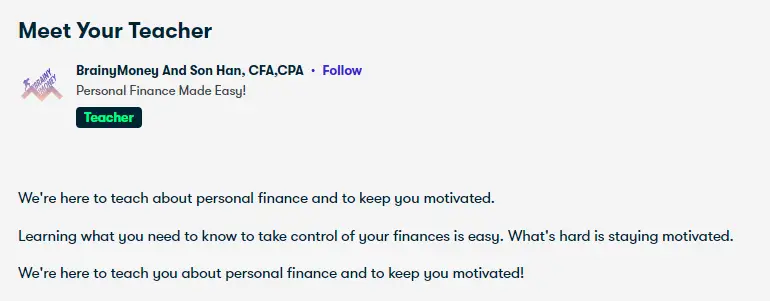

- 📝Instructor(s): BrainyMoney And Son Han, CFA,CPA (Personal finance instructor)

- ⌛Duration: 20m

“Learn How to Budget!” is a practical and concise course offered by Skillshare that teaches personal budgeting in just 16 minutes. The course offers step-by-step guidance on creating a realistic budget that can help individuals manage their personal finances and achieve their financial goals.

With easy-to-follow instructions and practical tips, this course is ideal for anyone who wants to take control of their finances and make smarter money decisions. Whether you’re a beginner or an experienced budgeter, this course is a valuable resource that can help you improve your financial wellbeing.

Meet the instructor:

What you will learn:

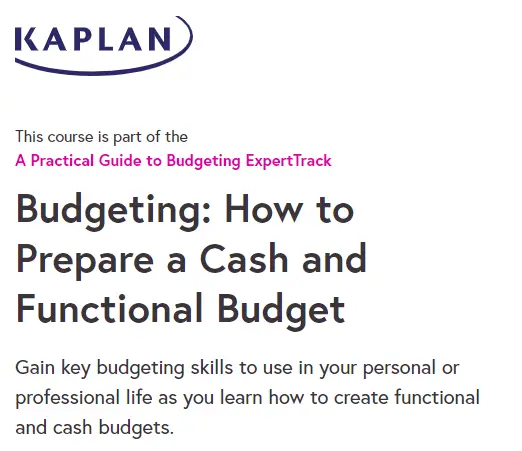

#9. Budgeting: How to Prepare a Cash and Functional Budget by Future Learn

Key info

- 🔗Course Link

- 💸Pricing: $39 for a verified certificate

- ❤️Popularity: 8,670 enrollments (as of Feb 2023)

- ⭐Rating: 4.6 (117 reviews as of Feb 2023)

- 📝Instructor(s): Kaplan (Kaplan UK is a leading international provider of educational and career services.)

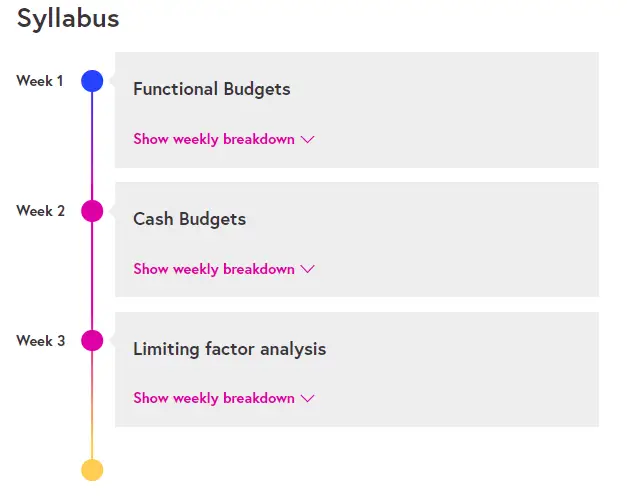

- ⌛Duration: 3 hours per week (3 weeks course)

The Budgeting course offered by Future Learn equips learners with the essential skills and knowledge to prepare a comprehensive cash and functional budget.

Throughout the course, participants will gain insights into the different types of budgets, the importance of budgeting, and the steps involved in developing an effective budget.

The course is designed to cater to the needs of learners with varying levels of expertise, making it an ideal choice for professionals and individuals seeking to enhance their budgeting skills.

Meet the instructor:

What you will learn:

#10. Fundamentals of Budgeting and Variance Analysis by Alison

Key info

- 🔗Course Link

- 💸Pricing: Free ($10 for a verified certificate)

- ❤️Popularity: 4,221 enrollments (as of Feb 2023)

- ⭐Rating: 4.7 (315 reviews as of Feb 2023)

- 📝Instructor(s): NPTEL’s Alison Stats (The National Programme on Technology Enhanced Learning is an online learning platform founded in 2003 by the coming together of seven Indian Institutes of Technology and the Indian Institute of Science.)

- ⌛Duration: 3-4 hours

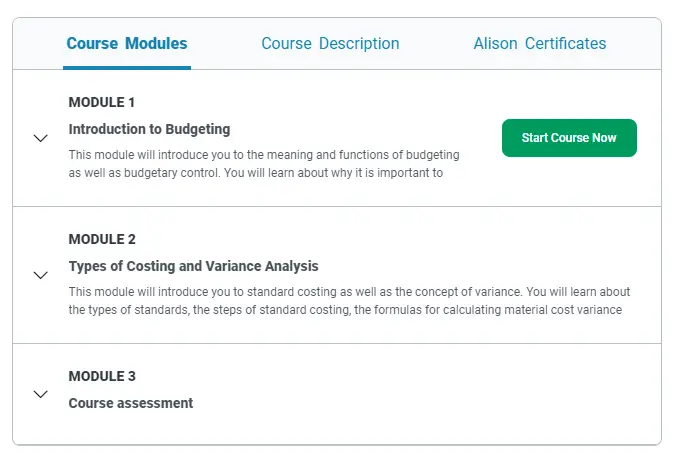

Alison’s “Fundamentals of Budgeting and Variance Analysis” free online business course is designed to equip learners with the knowledge and skills needed to create and manage budgets effectively.

The course covers the basics of the budgeting process, including the types of budgets and the steps involved in creating a budget.

Additionally, learners will gain an understanding of variance analysis, which is the process of comparing actual financial results to planned or expected results.

By the end of the course, learners will have a solid foundation in business budgeting and variance analysis, which can be applied in a variety of professional settings.

Meet the instructor:

What you will learn:

Pros & Cons of Online Courses for Planning & Budgeting

👍Pros:

- Flexibility: Online courses offer the advantage of flexibility in terms of time and location. Learners can access the course materials and complete assignments at their own pace, fitting them into their busy schedules.

- Access to Expertise: Online courses often feature instructors who are experts in the field of planning and budgeting. Learners can benefit from their knowledge, experience, and industry insights.

- Interactive Learning: Many online courses incorporate interactive elements such as discussion forums, virtual simulations, and multimedia resources. These interactive features promote active engagement and collaboration among learners.

- Cost-Effective: Online courses tend to be more affordable compared to traditional classroom-based courses. Learners can save on commuting costs, accommodation expenses, and other associated costs.

- Self-Paced Learning: Online courses allow learners to progress through the material at their own pace. This self-paced learning approach accommodates different learning styles and preferences.

👎Cons:

- Limited Face-to-Face Interaction: Online courses primarily rely on virtual communication, which may result in limited face-to-face interaction with instructors and peers.

- Self-Motivation and Discipline: Online learning requires self-motivation and discipline to stay on track with coursework. Without regular class meetings and deadlines, some learners may struggle to manage their time effectively and maintain consistent progress.

- Technical Challenges: Engaging in online courses necessitates basic computer literacy and reliable internet access. Technical difficulties, such as internet outages or software compatibility issues, can disrupt the learning process and cause frustration.

- Limited Hands-On Experience: Planning and budgeting often involve real-world scenarios that require hands-on application and practice. Online courses may have limitations in providing practical, hands-on experience, especially when compared to in-person workshops or internships.

- Reduced Networking Opportunities: Building a professional network is often considered an essential aspect of career development. Online courses may have limited opportunities for networking and establishing connections with fellow learners, instructors, and industry professionals.

Final Thoughts

In conclusion, with the plethora of online courses available on planning and budgeting, there’s never been a better time to learn how to take control of your finances. Whether you’re a beginner or an experienced budgeter, there’s something for everyone.

So why not take advantage of these resources and start your journey towards financial freedom today? What are your financial goals, and how do you plan to achieve them? Have you taken any online courses that have helped you improve your capital budgeting concepts?

Share your thoughts in the comments below and inspire others on their journey to financial success!

FAQs

Q1. What are the best online courses for planning and budgeting?

Some highly recommended online courses for planning and budgeting include “Financial Planning and Budgeting” by Coursera, “Budgeting for Business” by Udemy, and “Mastering Budgets: Budgeting and Forecasting” by LinkedIn Learning.

Q2. How do I choose the right online course for planning and budgeting?

Consider factors such as course content, instructor expertise, reviews and ratings, course duration, and flexibility. Look for courses that cover topics like budget creation, financial analysis, forecasting, and strategic planning to ensure comprehensive learning.

Q3. Are there any free online courses available for planning and budgeting?

Yes, several platforms offer free courses for planning and budgeting. Websites like Khan Academy, Alison, and FutureLearn provide free access to courses covering basic financial planning and budgeting concepts.

Q4. Can online courses for planning and budgeting help me in my personal finance management?

Absolutely! Online courses for planning and budgeting are designed to enhance financial management skills, whether for personal or professional purposes. These courses can provide valuable insights into budgeting techniques, saving strategies, and long-term financial planning.

Q5. How long do online courses for planning and budgeting usually last?

The duration of online courses for planning and budgeting varies depending on the platform and the depth of the course. Typically, courses range from a few hours to several weeks. Some platforms offer self-paced courses, allowing you to complete them at your own speed.

Q6. Can I receive a certification after completing an online course for planning and budgeting?

Yes, many online courses offer certificates of completion or achievement. These certificates can add value to your resume and demonstrate your knowledge and skills in planning and budgeting. Check the course details to see if certification is available.

Q7. What prerequisites are required for online courses in planning and budgeting?

Most online courses for planning and budgeting do not have strict prerequisites. However, a basic understanding of financial concepts, such as income, expenses, and basic accounting principles, can be beneficial. Review the course descriptions to determine if any prerequisites are mentioned.

Q8. Can I interact with instructors or other students during online courses for planning and budgeting?

Yes, many online courses offer opportunities for interaction with instructors and fellow students. This interaction can occur through discussion forums, chat platforms, or live sessions, allowing you to ask questions, share insights, and engage in meaningful discussions.

Q9. Are online courses for planning and budgeting suitable for beginners?

Yes, online courses for planning and budgeting cater to learners of different skill levels, including beginners. Look for courses labeled as introductory or beginner-friendly to ensure you acquire a strong foundation in planning and budgeting concepts.

Q10. Can online courses for planning and budgeting be accessed on mobile devices?

Yes, many online course platforms provide mobile applications or mobile-responsive websites, allowing you to access course materials and lectures on your smartphone or tablet. This flexibility enables you to learn on-the-go and fit your studies into your schedule.